Powerful secular trends have not only changed the way we live, but also invest. NEI Global Corporate Leaders Fund has been leading the way by investing in innovative companies aligned with these societal shifts.

Summary:

Powerful secular trends such as aging populations, urbanization, rising income in emerging markets, increased incidence of chronic disease, and the democratization of transformational technology have not only changed the way we live, but also invest. NEI Global Corporate Leaders Fund has been leading the way, investing in innovative companies aligned with these societal shifts. In its inaugural year, it has forged new paths to performance for investors, while navigating a rapidly changing market backdrop.

Performance (%) as of July 31, 2025 Series F |

|||||

|---|---|---|---|---|---|

| 3M | 6M | YTD | 1Y | SI1 | |

| NEI Global Corporate Leaders Fund | 7.61% | 1.34% | 6.64% | 12.52% | 12.53% |

Source: Morningstar Direct. Returns in base currency (CAD). 1Since inception date is July 15, 2024.

Navigating market volatility in 2025

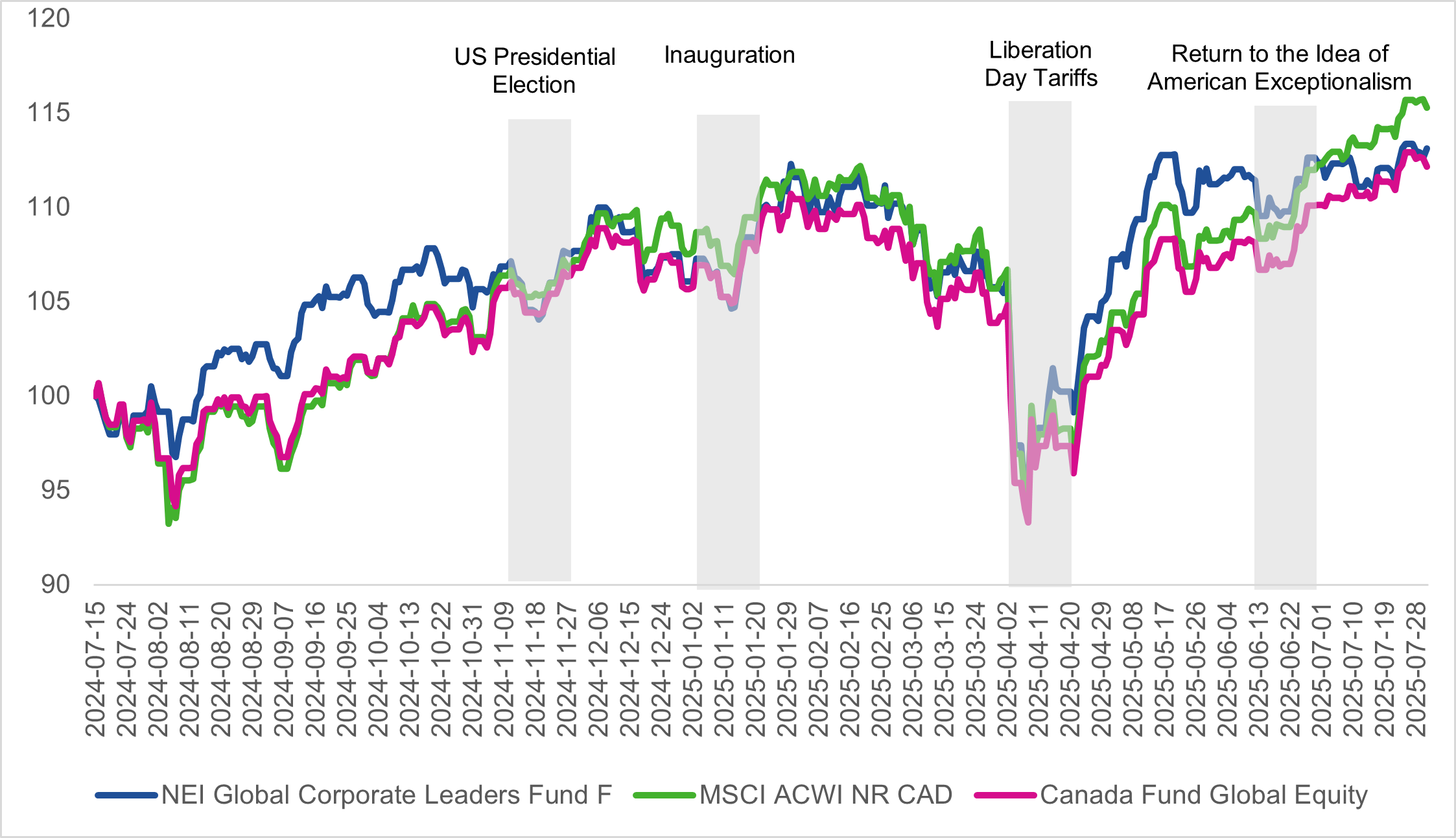

Since its launch, on July 15, 2024, the NEI Global Corporate Leaders Fund has navigated persistent global market volatility driven by geopolitical tensions, political shifts, and evolving fiscal and monetary policy. The re-election of Donald Trump as U.S. President initially boosted growth-sensitive assets but following his inauguration in January 2025 trade policy uncertainty and aggressive proposed tariffs weighed on investor sentiment.

During Q1 2025, Europe and China demonstrated resilience through fiscal stimulus and manufacturing recovery, while the US faced a mixed stock market reaction. Volatility peaked in Q2 2025 with Trump’s stringent “Liberation Day” tariffs and increased geopolitical tensions in the Middle East. However, by quarter-end, investor risk appetite improved, supported by progress in trade negotiations, strong corporate earnings, and optimism around Trump’s proposed fiscal expansion under the “One Big Beautiful Bill”.

Fund performance and strategic positioning

Amid this backdrop, the NEI Global Corporate Leaders Fund achieved strong results ranking in the top 27% within its global equity peer group. This result was achieved by focusing on understanding which risks were already priced into the market, and where there was a disconnect between short-term noise and long-term company value. One year performance ranks in the 27th percentile, out of 1790 investment peers, and reflects the fund’s agility, disciplined approach to valuation, and its conviction in high-quality, long-term investments.

Growth of $10,000 since Fund’s inception (Jul. 15, 2024 – Jul. 31, 2025)

Source: Morningstar Direct as of July 31, 2025. Returns in base currency (CAD)

Peers defined by Canada Fund Global Equity category. Funds in the Global Equity category must invest in securities domiciled anywhere across the globe such that their average market capitalization is greater than the small/mid cap threshold, and invest more than 10% and less than 90% of their equity holdings in Canada or the U.S. Funds that do not meet any of the requirements of other geographic equity categories and have no formal restrictions that limit where they can invest will be assigned to this category.

The MSCI ACWI captures large and mid cap representation across Developed Markets (DM) and Emerging Markets (EM) countries. The index covers approximately 85% of the global investable equity opportunity set.

Key contributors and secular exposure

The Fund’s dual focus approach on secular trends and companies with strong corporate cultures has proven to be both resilient and rewarding over the year. Exposure within the consumer discretionary space was a contributor, with companies such as MercadoLibre and eBay being standout performers.

A powerful long-term driver is the rise of emerging market middle classes, projected to account for 70% of global consumption by 2050 (up from just 25% in 2009). At the same time, rapid technological innovation is helping these regions overcome structural barriers, such as limited connectivity. The widespread adoption of broadband, for instance, enables instant digital access, unbound by traditional geographic constraints. MercadoLibre is at the intersection of rising incomes and digital transformation in Latin America, with its fintech and e-commerce platform well-positioned to meet the region’s evolving consumer needs.

In parallel, US re-commerce company, eBay further exemplifies disruptive technologies providing investment opportunities. As one of the most accessible platforms for sellers to generate income, eBay supports diverse revenue streams and by re-selling second-hand items, often at lower prices, it enhances affordability for price-sensitive, low-income buyers.

Meanwhile, in the information technology sector, positions in Halma plc and Nvidia have captured the upside of innovation-led growth. While Nvidia continues to play a pivotal role in powering the AI revolution, Halma plc offers a differentiated investment case. With a portfolio of specialist companies focused on safety, health, and environmental technologies, Halma plc combines an attractive valuation with long-term growth prospects, making it a compelling addition to the portfolio.

Outlook

While investor sentiment has improved, we expect markets to remain volatile as trade agreements are finalized, and the effects of inflation continue. In this context, diversification remains essential. The fund’s emphasis on companies aligned with powerful growth opportunities and resilient corporate cultures creates a broad, differentiated opportunity set, offering investors a unique source of alpha. We believe this makes it a compelling global equity allocation for thematic portfolios looking to mitigate tracking error and factor-specific risk, while also complementing broader environmental portfolios such as the NEI Environmental Leaders Fund. With minimal overlap between the funds, our research shows that a combined portfolio can potentially reduce tracking error while increasing the impact of active stock selection.

Long-standing partnership

As global markets continue to evolve, the NEI Global Corporate Leaders Fund is well-positioned to continue delivering strong performance. Supporting this fund is Impax’s strong and highly valued partnership with NEI, which brings a shared commitment to responsible investing. Through close coordination on Corporate Resilience, active ownership, and long-term engagement, this collaboration enhances the fund’s ability to align with investor goals.

"We deeply value the support of NEI and the shared commitment to this fund. Looking ahead, we remain focused on driving growth and delivering strong, consistent results for our clients."

Impax Asset Management

Invest in companies seeking to lead markets forward by solving for today’s and tomorrow’s societal challenges. Discover how the NEI Global Corporate Leaders Fund can help you navigate an evolving market landscape and achieve your long-term financial goals.