Canadian advisors face shrinking bandwidth. Our approach brings global strategies and disciplined monitoring, to ease your workload, while expanding portfolio possibilities for your clients.

Summary:

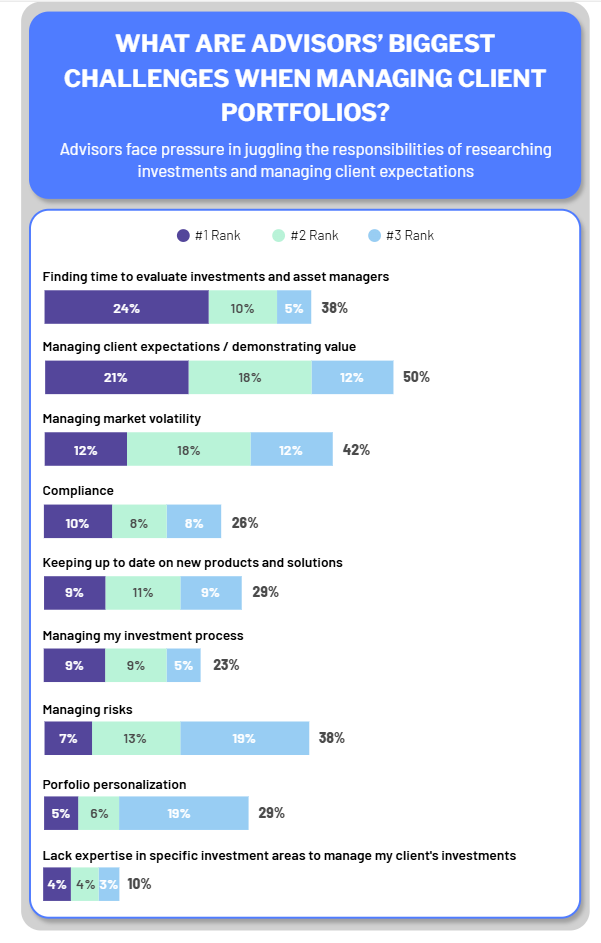

Canadian advisors face two persistent challenges. The first is time. Advisors consistently say their biggest struggle is finding enough hours to properly evaluate investment products and the managers behind them, while still meeting the demands of client service. The second is scope. Canadian investors often rely heavily on products managed locally, which limits access to the broader strategies and perspectives shaping markets globally.

This is the space where Will Benton, Vice President of Manager Research & Oversight at NEI Investments, through a manager-of-managers model, provides continuous oversight of sub-advisors while giving advisors and their clients access to investment expertise that would otherwise be out of reach. The open-architecture model results in both a wider lens and a lighter workload.

“We’re working with firms who generally aren’t accessible in Canada,” he says. “Sometimes it’s not about the product but the way a manager approaches research. The unique perspectives of these global managers simply don’t exist here, and that’s what we bring to advisors. Our oversight ensures that advisors don’t have to spend their own time monitoring managers.”

According to a survey of 800 advisors across Wirehouse, Regional, Independent, Bank & RIA channels in July 2024, sponsored by ISS MI Market Intelligence.

The importance of this work is underscored by findings by ISS Market Intelligence in July 2024, which shows that advisors are placing greater emphasis on familiarity with fund managers, proven track records, and a clear understanding of investment processes, elements they believe lead to superior outcomes for clients.

A broader toolkit without added burden

For many advisors, the challenge is not just time but access. Even if they wanted to evaluate every global manager themselves, many of those strategies are not available directly in Canada. That is where Benton’s team comes in.

“When we selected Amundi for the NEI Global Total Return Bond Fund followed roughly six months of research and due diligence,” Benton explains. “We reviewed their process, assessed the team, and ensured their approach added something Canadian investors couldn’t already find.

“Once selected, our oversight is continuous, involving daily performance monitoring and deeper, often on-site reviews of operational areas such as compliance, trading, and cybersecurity. A ransomware attack or an inefficient trading desk can affect results just as much as a poor investment call. We handle these so advisors don’t have to.”

Benton describes it as daily monitoring paired with in-depth, often on-site reviews of each manager’s operations, from compliance and trading to cybersecurity safeguards.

Advisors gain exposure to specialist managers and differentiated perspectives, but the responsibility for monitoring performance and operational resilience rests with NEI.

Catching themes before they become client questions

The advantage of global access is not only diversification but also foresight. Benton recalls that nearly a decade ago, NEI partnered with Impax Asset Management, one of the only firms worldwide then analyzing companies through an environmental impact lens. “At the time, no one in Canada was framing investments that way,” he says. “They did it because they felt it was the better investment decision, not because it was a trend. Now it’s more broadly available, but our clients had that exposure early.”

Global access offers diversification and foresight. NEI partnered with Impax Asset management, nearly a decade ago, giving clients early exposure to environmental impact strategies. Similarly, NVIDIA, a top performer in the NEI Global Corporate Leaders Fund, exemplifies how innovation today is driven by culture and talent, not factories. Benton adds, ‘By holding forward-looking strategies, advisors can prepare for client conversations before trends hit the headlines.’”

He sees a similar pattern in other offerings such as the NEI Clean Infrastructure Fund, sub-advised by Ecofin Advisors, which is designed around the rising demand for electricity as industries move toward renewable power and electrification. “Electricity demand was relatively flat for twenty years, but that’s changing,” Benton explains. “When you think about electric vehicles, renewable generation, and now AI data centers, you start to see why we’ll need far more power. That’s a global trend we wanted to give advisors access to.”

Scale and independence: NEI’s unique edge

NEI’s sub-advisors collectively manage close to ten trillion dollars worldwide, which provides not just cost-efficient access but also a stream of insights.

“Our relationships give us a clear view of where global pensions are allocating, which sectors are gaining traction, and which themes have lasting potential,” Benton explains. “This context helps us identify managers who deliver real value, not just those riding market trends.”

What sets NEI apart is its independence. Unlike many Canadian asset managers that rely on internal teams, NEI avoids the rigidity of in-house decision-making. “We’re not tied to protecting internal resources,” Benton says. “Our focus is fully aligned with investors and their outcomes.”

NEI also excels at placing qualitative diligence in market context. “It’s not enough to know a manager’s process,” Benton adds. “We assess whether their results come from skill or simply a favorable market. That’s how we consistently find managers who add true value.”

Responsible investing has also become part of that process, not as a checkbox but as a way of sharpening decisions. “The question for us is always how the responsible investing lens improves the investment outcome,” Benton says. “It is about understanding how culture, governance, or environmental impact can influence performance, not just screening for labels.”

As RRSP season approaches, Benton’s message is clear: advisors can trust NEI to identify and monitor managers, freeing them to focus on clients. “Sometimes the value isn’t in adding more but in widening the lens,” he says.

Discover how NEI can give you and your clients a unique edge.