Key findings from our 2022 corporate dialogues.

THE YEAR IN REVIEW

Key findings from our 2022 corporate dialogues

Jamie Bonham, Head of Stewardship

We engaged 222 companies in our portfolio in 2022, representing 43% of our equity assets under management. This exceeded our 30% target that we set for ourselves at the beginning of the year. In this fast-changing landscape, we find that our corporate engagement program—a longstanding pillar of our responsible investment program—is even more relevant as companies and investors alike navigate the inherent complexities of environmental, social and governance issues.

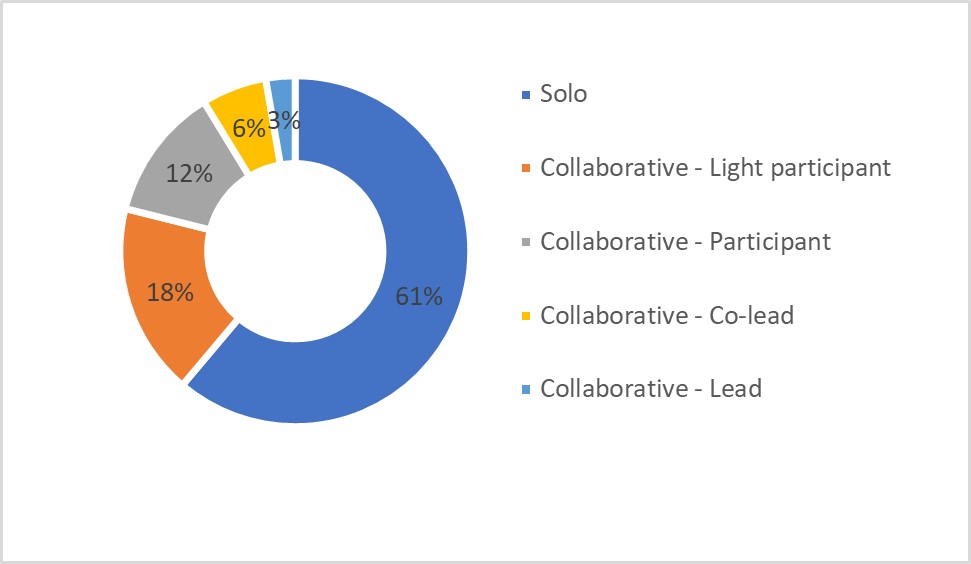

The priority we place on taking an active role is evidenced by the fact that we were either a lead, co-lead or solo engager for 70% of our engagements, meaning we were actively setting the agenda and engagement strategy, leading the dialogues in meetings, creating the content of letters, and organizing next steps. This gives us a higher degree of influence and control over the engagement process itself, where we believe it is extremely important to be aware of the impact of tone and finding the right balance between supporting the positive developments of internal champions while also knowing when to push for better performance. Effective listening is one of our strongest tools, as it allows us to best align our requests with existing corporate strategy.

That said, we also find great value in lending our voice to support the work of other investors who have taken the lead on topics that are important to us but may be outside our focus themes. Eighteen percent of our engagements were categorized as “light participant,” where we supported letter campaigns and other initiatives but did not play a direct role in the engagements. The largest contributor to this category was our ongoing support of the Business Benchmark on Farm Animal Welfare, which focuses on companies in the food value chain to ensure they are incorporating best practices in animal welfare.